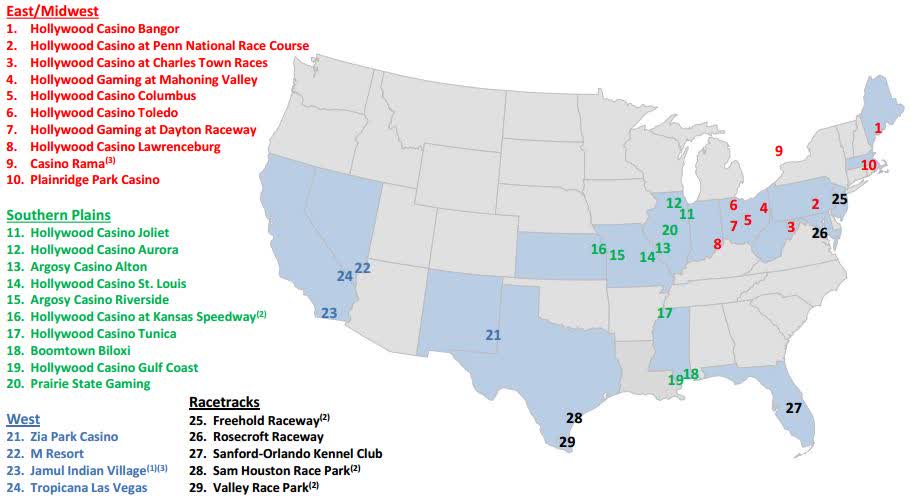

In February 2020, Penn National entered into a strategic partnership with Barstool Sports, whereby Barstool is exclusively promoting the Company's land-based and online casinos and sports betting products, including the Barstool Sportsbook mobile app, to its national audience. Bet on sports with the Barstool Sportsbook from Penn National Gaming (NASDAQ: PENN) and Barstool Sports while enjoying the same online sports betting experience used by Dave “El Presidente.

It remains to be seen how policymakers would approve statewide mobile wagering or if they can reach consensus on the legislation to do so, but Penn National and its growing Barstool brand raise the stakes for 2021’s biggest sports betting prize. Install our App and Create your Free Account-Choose your Teams and Place your Bets-Follow Along Live-Come Back for More Games, Teams, and Bets Barstool Sportsbook & Casino operated by Penn National Gaming, Inc. And licensed subsidiaries. Gambling problem? Call 1-800-GAMBLER for help. Sportsbook wagering currently only available in PA & MI. View the Webcast. WYOMISSING, PA (Jan. 29, 2020) – Penn National Gaming, Inc. (PENN: Nasdaq) (“Penn National” or the “Company”) announced today that it has entered into an agreement to acquire a 36% interest in Barstool Sports, Inc. (“Barstool Sports”), a leading digital sports media company, for approximately $163 million in cash and convertible preferred stock.

Penn National is America’s new hottest gaming stock. The company is up some 1,200% from its pandemic lows to around $53 at the time of writing.

And just like DraftKings earlier this year, analysts keep raising their price targets higher and higher as the stock climbs.

Goldman Sachs became Penn’s latest supporter last week, initiating the stock as a ‘buy’ with a $60 price target.

“Penn sits at the cross-section of a rapidly rebounding regional casino space and inflecting growth in sports betting,” Goldman analyst StephenGrambling wrote.

Breaking down Barstool Sportsbook economics

Grambling argued Barstool Sportsbook’s customer base and content creation engine would drive “one of the lowest customer acquisition costs in the industry,” allowing Penn to quickly take sports betting share.

Goldman estimated the upcoming Barstool Sportsbook app could acquire customers at $57 compared to $193 for DraftKings and $190 for FanDuel. For further context, BetMGM said last week it hoped to reach a blended $250 CPA.

Goldman also pointed to Barstool’s social media reach, saying the two factors pointed towards a 15% market share for the Barstool Sportsbook.

“Based on our DKNG valuation, that methodology would drive a $4.5 billion valuation for Barstool/Penn sports betting alone,” Grambling said.

Penn National Barstool Appliance

That’s $4.5 billion out of a current Penn market cap of $7 billion. In other words, a huge amount of Penn’s current market value is already driven by the Barstool Sportsbook.

As RoundhillInvestments CEO WillHershey put it recently:

“This is not hyperbole — the Penn Barstool acquisition may be one of the best deals of all time. I wonder what position the company would be in had it not gotten done.”

Questions to be answered for Penn National

If that $4.5 billion valuation stems from massive sports betting growth on strong margins, is it realistic?

Here’s more from Goldman:

“From the company’s 66 million monthly unique visitors, 62% bet on sports with 44% of those betting at least 1x per week. Additionally, 65% of their audience is in the key 21-44 age group. The cross-section implies a potential database of users that actively bet on sports of 18 million. Even if only 10% of these users are converted to the Penn/Barstool app, [that’s 1.8 million users.]”

Penn National, of course, already paid $163 million for access to that customer database by buying its Barstool stake. So ignoring that cost in new CPAs seems a little disingenuous.

But perhaps more importantly, there’s an assumption of 1.8 million sign-ups for a product the world has not seen yet.

And the app is on track to launch in September instead of August as initially planned, perhaps a tiny warning sign.

“What’s more important?” Penn CEO JaySnowden said at the firm’s recent Q2 results. “Rushing it and getting to some MLB and NBA games in August? Or doing this right, launching it in September when we know it will deliver a great experience for the end user?”

Execution is key

Getting it right is, of course, more important than rushing it. But it’s also a risk to debut your first-ever sports betting app into the furnace of NFL betting.

Do you want any bugs exposed on those sleepy days in August, or on NFL Sunday when 50,000 Philly fans log on at 1 pm EST to back the Eagles?

The product really is key here, and, of course, it’s an unknown. But there is likely a low bar to clear. We know the Kambi back-end should work – DraftKings and BetRivers have built good market share on the back of it.

Combine that with the Barstool marketing machine, and the Penn front-end really just has to be good enough.

Why that’s the case

As Eilers & Krejcik analyst AlunBowden put it in a recent note: “Barstool is a different beast. There is no doubting the willingness or desire of the team to throw themselves at gambling promotion.”

He added, however: “Barstool will have to excel at the fundamentals to make this work in product, retention, customer service, and trading. And that is not as easy as it looks.”

It’s not, and it’s an area Penn may struggle, simply because it’s new to the space and sports betting is operationally complex. But it’s worth remembering it took Sky Bet in the UK nearly a decade to back up its media presence with a great product. And when it did, it exploded.

Barstool has a clear route to a similar level of success. The road just might be bumpier than some analysts are expecting.

Buy or sell Penn National stock?

As for the Penn valuation, a word of warning: earlier this year when $DKNG was soaring, one reason was its exclusivity.

It was essentially the only way for US investors to get access to the US online sports betting industry.

That is changing rapidly. Companies like MGMand CZRare now pushing their sports betting operations to investors. Companies like GAN, Rush Street Interactive, and Sportradar can (or could) also offer some exposure to the sector. Or investors can just pick an entire bundle of sports betting stocks via the $BETZ ETF.

Penn National Barstool App

Either way, if price is a function of supply and demand, a growing glut of supply can’t be good for any individual stock’s price.

Penn National Barstool Appeal

As a result, while the Barstool Sportsbook may deliver on its massive promise, it is far from a sure bet.